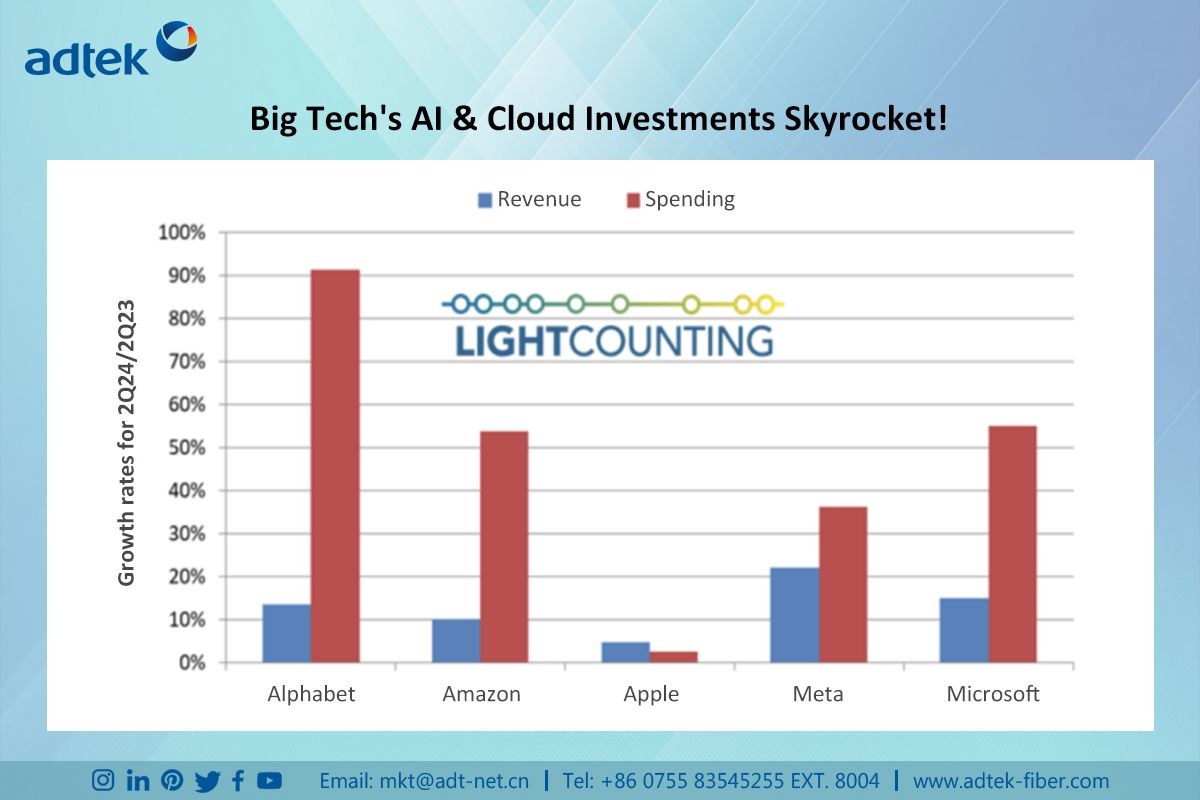

In Q2 2024, leading tech companies dramatically increased capital spending, driven by surging demand for AI infrastructure. Google and Microsoft led the pack with 91% and 55% growth, respectively, while Amazon and Meta saw spending rise by 54% and 36%. The bulk of this investment is focused on cloud data centers, including servers, GPUs, CPUs, and optical connectivity.

Unlike the tech giants, telecom providers reported lower spending, though Lumen secured $5 billion in network orders due to AI demand. This trend highlights the growing role of AI and fiber-optic infrastructure in shaping the future of global communication.

AI-driven capital expenditures are expected to exceed $1 trillion by 2028, with global server revenue projected to reach $500 billion. AI accelerators like GPUs will power over half of these servers, driving demand for advanced optical connections in data centers. Cloud giants such as Amazon, Google, Meta, and Microsoft will dominate the global data center market, accounting for half of all capital expenditures by 2026.

While many telecom companies cut back on spending, Lumen’s new AI-related network orders are a bright spot. As enterprises seek to bolster their fiber capacity to support AI workloads, industry analysts predict telecom companies will see renewed spending growth by 2025.

AI infrastructure investments also influenced network equipment sales, with companies like Arista and Lenovo reporting notable growth, while traditional vendors like Nokia and Ericsson saw declining sales. In the semiconductor space, AMD and MACOM posted quarter-over-quarter gains, while Intel’s revenue remained flat, and the company forecast further declines and significant layoffs through 2025.

Looking ahead, the need for AI and 5G infrastructure will drive robust investments. AI cluster demand will propel the market for optical components, with suppliers like Lumentum and AOI forecasting growth in the second half of 2024. By 2028, AI accelerators will grow at a compound annual growth rate (CAGR) of 38%, while 5G mobile backhaul equipment demand is set to rise at 13% CAGR.

Open RAN technology will capture over 25% of the radio access network market by 2028, with North America leading adoption.

If you want to know more about us, you can fill out the form to contact us and we will answer your questions at any time.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

These cookies are used for managing login functionality on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Clarity is a web analytics service that tracks and reports website traffic.

Service URL: clarity.microsoft.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy for ADTEK.