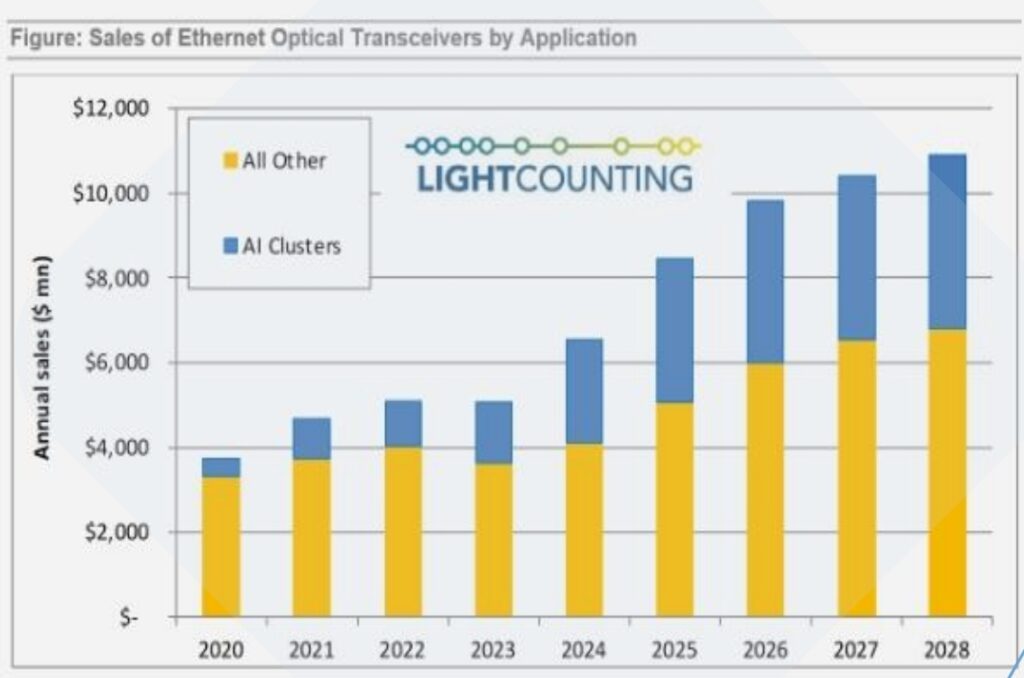

The demand for Ethernet optical transceivers in AI clusters is soaring, and the market is set to more than double in 2024. This rapid growth is expected to continue through 2025 and 2026, but it won’t last forever. Industry forecasts suggest a “soft landing” in 2027, potentially followed by a downturn. According to LC’s latest predictions, the sales surge for Ethernet optical transceivers used in AI clusters will peak, but like any market, a decline is expected eventually—typically every three years.

NVIDIA’s significant role in the optical module market is also under review. Many of its customers, including Microsoft, have been purchasing fully equipped systems that come with all transceivers. While not the most cost-efficient approach, it’s seen as part of the current arms race in AI infrastructure. However, LC predicts that more companies will soon bypass NVIDIA and source optical modules directly, thereby reducing its market share in this space.

In 2023, early major buyers like Google and NVIDIA increased their transceiver purchases significantly, with all leading cloud companies joining the competition. Demand for 4x100G and 8x100G transceivers currently exceeds supply by more than 100%, with some customers waiting until 2025 for delivery. LC has adjusted its forecast for 4x100G transceivers, projecting an additional $500 million in sales in 2025 and $1 billion more in 2026, with sales expected to peak above $4 billion in 2026. Similarly, sales of 8x100G transceivers are forecasted to increase by $2 billion in 2025, reaching over $7 billion in 2026.

The next wave of transceiver technology is also on the horizon. The first 4x200G and 8x200G transceivers will ship by the end of 2024, with LC revising its forecast for these modules upwards. Moreover, LC has added 3.2T transceivers to its model, anticipating that by 2029, 1.6T and 3.2T transceivers, along with LPO and CPO, will dominate the market, driving AI optical sales to nearly $10 billion.

As the market adjusts, it’s clear that we’re entering a period of high demand for advanced optical solutions, but companies must prepare for a potential market cooldown post-2027. How organizations adapt to these trends could define their position in the AI race for years to come.

If you want to know more about us, you can fill out the form to contact us and we will answer your questions at any time.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

These cookies are used for managing login functionality on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Clarity is a web analytics service that tracks and reports website traffic.

Service URL: clarity.microsoft.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy for ADTEK.