Since the advent of the information age, digital transformation has dramatically reshaped computing infrastructure. Data centers have progressed from modest, localized server rooms to global-scale, hyperscale facilities supporting cloud computing, AI workloads, ultra-large-scale networks, and high-performance computing. At the heart of this evolution lies optical communication technology — a high-bandwidth, low-latency transmission medium that has progressively displaced traditional copper cabling for core data center connectivity.

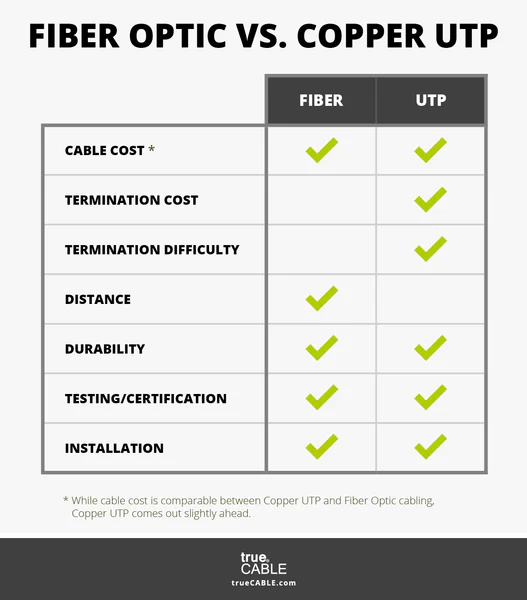

In the early stages of data center development, copper cabling (e.g., Category 5/6/7) served as the primary transmission medium. Its advantages were clear:

Lower upfront cost

Compatibility with existing hardware

Ease of installation

However, copper cabling has intrinsic technical limitations — including signal attenuation, electromagnetic interference (EMI), and limited bandwidth capacity — that restrict its suitability in high-speed, long-distance deployments within data centers. These constraints became more pronounced as computing demand grew, especially with workloads such as large-scale databases and early cloud services.

As network speeds climbed and data volume exploded, copper reached a performance ceiling. Fiber optics, by contrast, offered several critical advantages:

Much higher bandwidth capacity — supporting 100G, 400G, 800G, and beyond

Longer distance transmission without significant loss

Immunity to electromagnetic interference

Lower latency and better scalability

Enhanced reliability for future upgrades

These characteristics quickly made fiber optics the backbone choice for modern data centers, especially hyperscale facilities.

According to structured cabling market analysis, fiber optic cabling accounted for approximately 59% of data center cabling market share in 2024, overtaking copper in many new deployments. The trend is expected to continue as data centers upgrade and expand to support new workloads.

In another analysis, copper held roughly 50% of structured cabling share in 2024, indicating that while copper still has a role in certain shorter-distance or legacy applications, fiber optics is rapidly taking dominance.

This trend reflects the accelerating adoption of fiber optics as the core transmission medium — driven by performance requirements and long-term scalability.

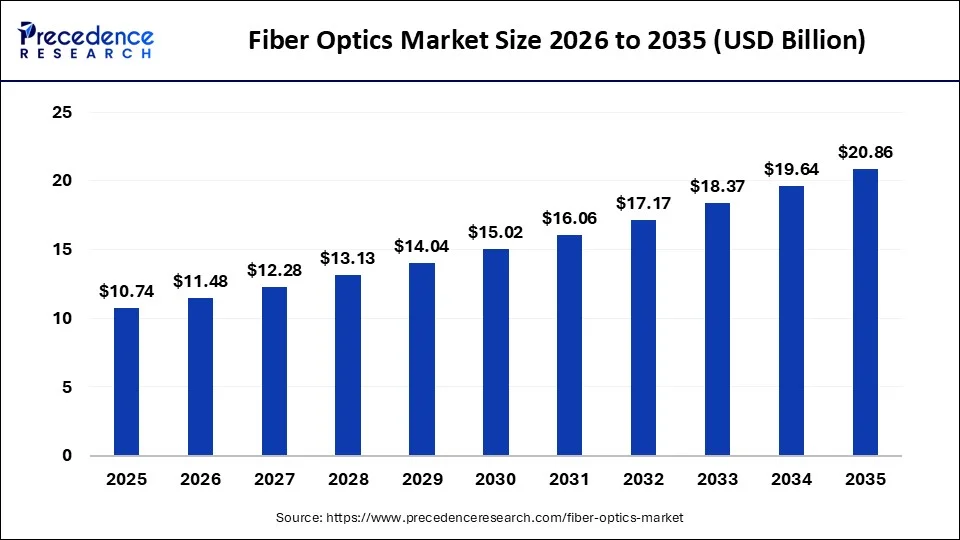

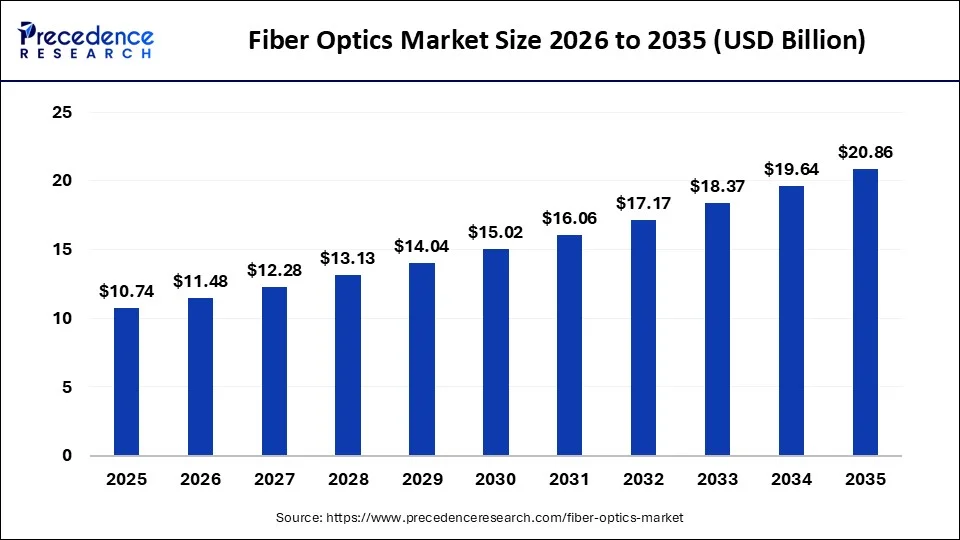

According to global market forecasts:

The data center cabling market was valued at approximately USD 7.1 billion in 2024 and is projected to grow at around 8.9% CAGR through 2034, with fiber optics accounting for the majority share.

This expansion is tied closely to the adoption of higher-speed links (400G / 800G / 1.6T), cloud infrastructure growth, and emerging applications that demand massive data throughput and minimal latency.

Copper cabling traditionally supports up to 10 Gbps–25 Gbps at distances under 100 m. In contrast, fiber optics enable:

100 Gbps to 400+ Gbps links in standard deployments

800 Gbps and beyond with advanced modulation

Long-distance links across campus or cross-site infrastructures

The gap between copper and fiber has widened as data center topologies scale up and as networks consolidate traffic across racks, rows, and facilities.

With ongoing demand for cloud services, AI training clusters, and ultra-high-speed interconnects, fiber optic adoption is expected to continue accelerating. Hyperscale operators, in particular, favor fiber for backbone and interrack connectivity due to its scalability, reliability, and future-proof nature.

The transition from copper to fiber optics in data centers reflects the broader evolution of computing infrastructure in the information age. While copper continues to serve specific legacy or short-distance needs, fiber optics has become essential for modern high-performance data centers due to:

Superior bandwidth and scalability

Long-term operational cost advantages

Compatibility with advanced network technologies

Support for AI, cloud, and emerging workloads

This transformation illustrates how optical communication has not only kept pace with data demand, but actively enabled the expansion of global digital infrastructure.

If you want to know more about us, you can fill out the form to contact us and we will answer your questions at any time.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

These cookies are used for managing login functionality on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Clarity is a web analytics service that tracks and reports website traffic.

Service URL: clarity.microsoft.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy for ADTEK.