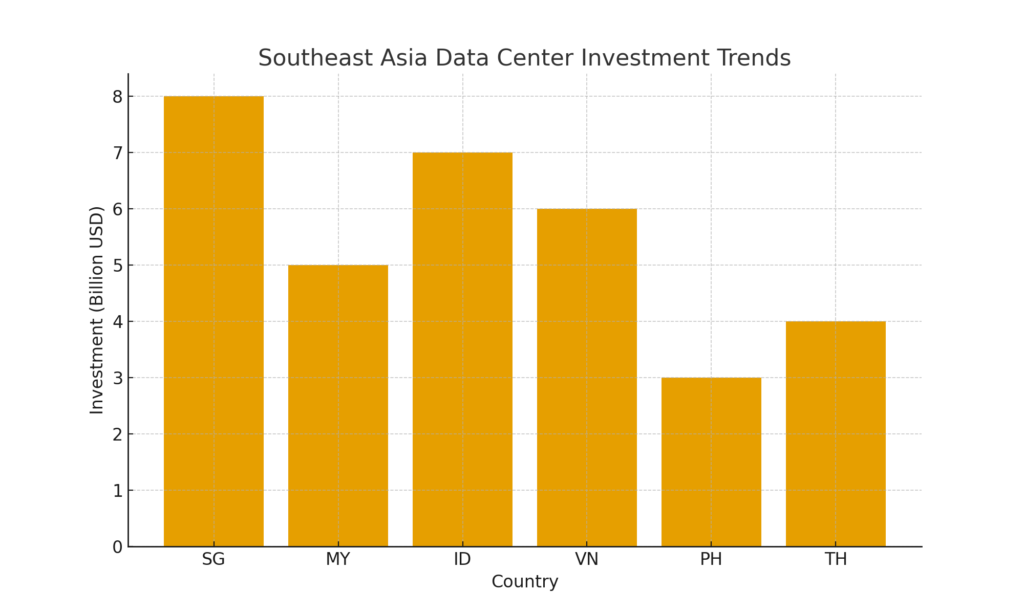

Southeast Asia is rapidly rising as one of the most dynamic frontiers for global optical communications. Fueled by national digital strategies, rising cloud and data-center investments, and a younger, cost-effective labor force, the region is witnessing a surge in demand for high-speed optical connectivity. At the same time, global data-center and AI infrastructure expansion is accelerating — creating an unprecedented global wave of demand across fiber, transceivers and network hardware.

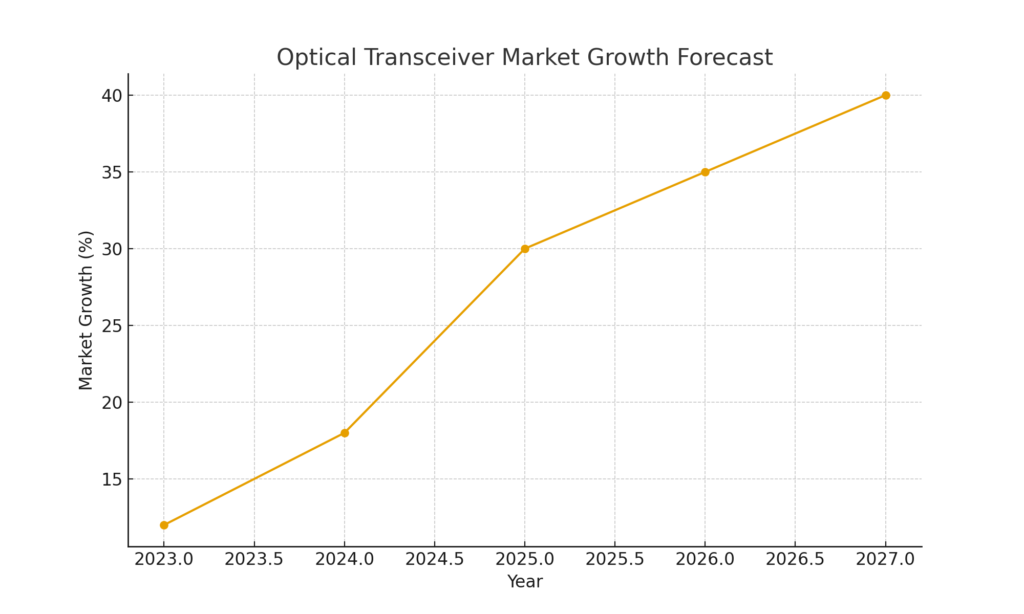

A recent report from a leading optical-market analysis firm shows that optical transceiver demand driven by AI clusters grew sharply during 2023–2025 — and is expected to continue rising through 2030.

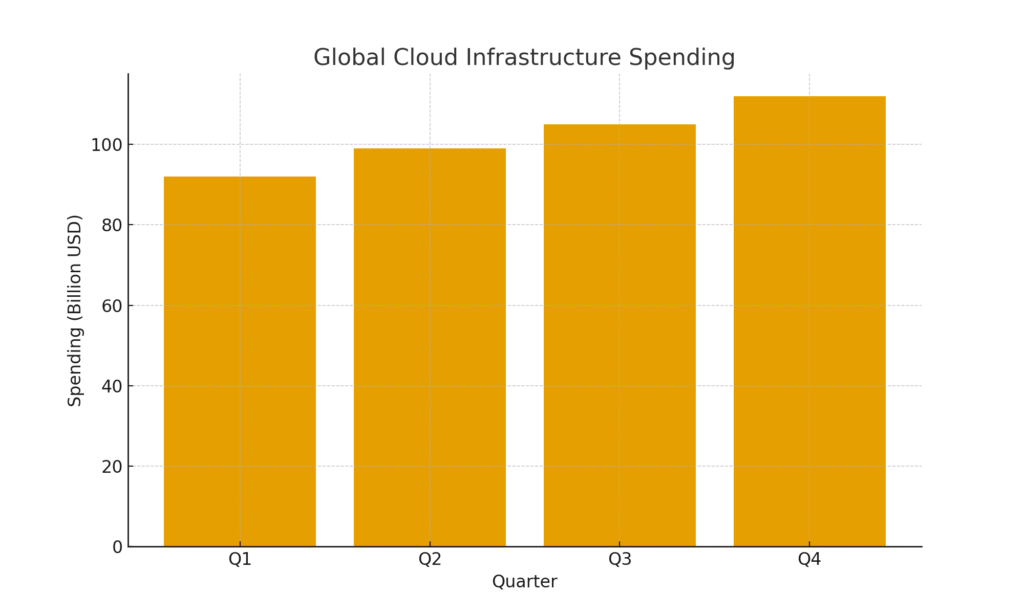

Global cloud infrastructure spending recently reached US$99 billion in Q2 2025, a 25% year-on-year increase.

As hyperscale cloud and AI workloads expand, demand for higher bandwidth (e.g. 400G, 800G, and beyond) grows accordingly. Market analyses indicate 800G and 1.6T-class optical modules are rapidly becoming the mainstream in new data-center deployment cycles.

These macro trends — AI-driven compute demand, cloud service growth, and global data-center expansion — are aligning to drive a new wave of investment in optical infrastructure globally.

Operators and enterprises are increasingly looking beyond traditional hubs for new capacity. Southeast Asia stands out for several reasons:

Digital transformation policies in multiple countries are accelerating adoption of broadband and cloud services.

Economic growth and available labor make the region attractive for both data centers and manufacturing.

Supply-chain diversification (“China + N” strategy) — to mitigate geopolitical or regional supply-chain risks — fosters relocation of assembly and production capacity to Southeast Asia.

Together, these factors make Southeast Asia strategically important for future growth in network deployment, fiber rolls, data-center connectivity, and even transceiver manufacturing or assembly.

Despite the momentum, several structural obstacles stand in the way:

Regulatory and legal uncertainty — many countries in Southeast Asia are still developing frameworks for data-center regulation, environmental compliance, and fiber infrastructure permits.

Incomplete local infrastructure and supporting industries, such as mature fiber-optic supply chains, clean-room manufacturing, and skilled workforce for high-speed optical component assembly.

Environmental and labor regulation shifts — which may impact costs and operational stability.

Currency and exchange-rate volatility, especially in markets like Vietnam and Indonesia, creating financial risk for foreign investors.

These uncertainties mean that while demand is real, projects must be planned carefully to manage risk.

As demand for bandwidth and density grows, the industry is responding with innovations in fiber connectivity and optical platforms:

High-density optical modules (400G / 800G / 1.6T) are rapidly becoming mainstream.

The shift toward co-packaged optics (CPO) and high-density architectures helps data centers accommodate large bandwidth needs with limited rack space.

For data-center interconnect (DCI) and backbone expansion, operators are turning to modular fiber distribution, high-density patch panels, and future-proof optical infrastructure that can support 800G to 1.6T and beyond.

| Trend | What to Watch |

|---|---|

| CPO / High-Density Optics Adoption | As AI and hyperscale workloads expand, demand for ultra-dense fiber and optical interconnect will grow. CPO is likely to become the standard for new builds. |

| Regional Expansion: Southeast Asia & Emerging Markets | New data-center builds and fiber deployment across SEA will drive demand sector-wide. Supply-chain diversification may accelerate “China + N” strategies. |

| Integration of Optical & Cloud Infrastructure | As cloud spending rises (e.g. recent $99B quarter), optical infrastructure becomes more tightly coupled with cloud growth—driving DCI, backbone, and metro fiber expansion. |

| Shift to 800G / 1.6T / 3.2T Modules | 800G modules are already mainstream; 1.6T and next-gen optics will see increasing adoption for data-center interconnect and AI clusters. |

| Demand for Flexible, Modular Optical Infrastructure | Operators will increasingly prefer modular patch panels, fiber-distribution frames, and scalable designs that support upgrades without forklift changes. |

The global optical connectivity market stands at a major inflection point. AI and cloud growth, coupled with supply-chain diversification and regional expansion, are driving demand at an unprecedented pace. Southeast Asia is emerging as a key strategic region — not only for deployment but also for manufacturing and supply-chain resilience.

However, risks remain. Regulatory uncertainty, infrastructure gaps, and market volatility can pose challenges. Success will hinge on adopting flexible, high-density, and future-proof optical solutions — and partnering with suppliers and vendors who understand both the technological and market complexities.

For companies ready to scale, 2025–2030 presents a window of enormous opportunity. The next wave of global optical network deployment is underway — and the landscape will look very different by 2030.

If you want to know more about us, you can fill out the form to contact us and we will answer your questions at any time.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

These cookies are used for managing login functionality on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Clarity is a web analytics service that tracks and reports website traffic.

Service URL: clarity.microsoft.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy for ADTEK.