Last-mile fiber builds face a unique set of real-world hurdles beyond core network issues. Local permitting and coordination often add months or years to a build. For example, utility pole attachment approvals can take months or even years, creating critical path delays for broadband projects[1]. One recent analysis noted U.S. infrastructure projects (including broadband) can be delayed 5–10 years by regulatory reviews[2]. These bottlenecks not only hold up service rollout but also inflate costs and risk losing time-limited funding.

Regulations and municipal processes also intersect with civil works. Dig-permit applications, environmental reviews (e.g. NEPA in the U.S.), traffic control plans, and coordination with utilities all add overhead. Stakeholders have warned that without streamlined, “dig-once” and pole attachment reforms, these procedural delays could “undercut the historic wave of federal investment” in broadband[3]. In short, build schedules must now account for weeks or months of permitting and make-ready work that were not foreseen in simpler deployments.

The massive surge of funding (from programs like BEAD/CPF and elsewhere) has outstripped the skilled labor pool. A recent Fiber Broadband Association study predicts U.S. broadband funding will exceed current workforce capacity, pushing many projects “two to three years into the future” and even risking expiration of grants[4]. It estimates that roughly 28,000 more construction crew members and 30,000 more field technicians are needed immediately, plus an additional 119,200 over the next decade to simply absorb projected workload[5]. In other words, nearly 180,000 trained fiber-build workers are required across America (and similar shortages exist globally) just to keep up with planned builds.

This shortage spans all roles – from engineering and planning to splicing and testing. In fact, industry surveys show >90% of contractors report “high difficulty” finding qualified installers[6]. With so few craft-trained technicians available, projects often face delay or must resort to less-experienced crews. The result is cascading bottlenecks as operators scramble to hire, train, and retain fiber professionals. Accelerated training programs (like FBA’s OpTIC Path certification) are helping, but most analysts agree the skills gap remains a top obstacle[7].

Hardware diversity in the field increases complexity for installers. There is “so much variation among enclosures and terminals” (different shapes, sizes, connector types, etc.) that simply sourcing and stocking the required parts becomes difficultp[8]. For example, a contractor may need different splice closures, connector adapters (SC/APC vs. LC vs. ST), and cable assemblies depending on each vendor’s standards. Mismatched or proprietary connector systems can create field compatibility issues; even mating connectors from different manufacturers is typically discouraged, as performance may degrade without tight quality control. In practice, such mismatches can lead to higher loss or rework if a wrong adapter or fiber grade is used.

Inventory fragmentation compounds this issue. In a typical large build, crews must manage dozens of unique part numbers for drop cables, enclosures, splice trays, pigtails, etc. One telecom supplier reported that a modular fiber-to-the-home platform cut their necessary component count by 75%, illustrating how integrated designs greatly simplify stock management[9]. More generally, fragmented inventories raise costs: purchasing and tracking many SKUs ties up capital and floor space. It also slows deployment if a needed part runs out unexpectedly.

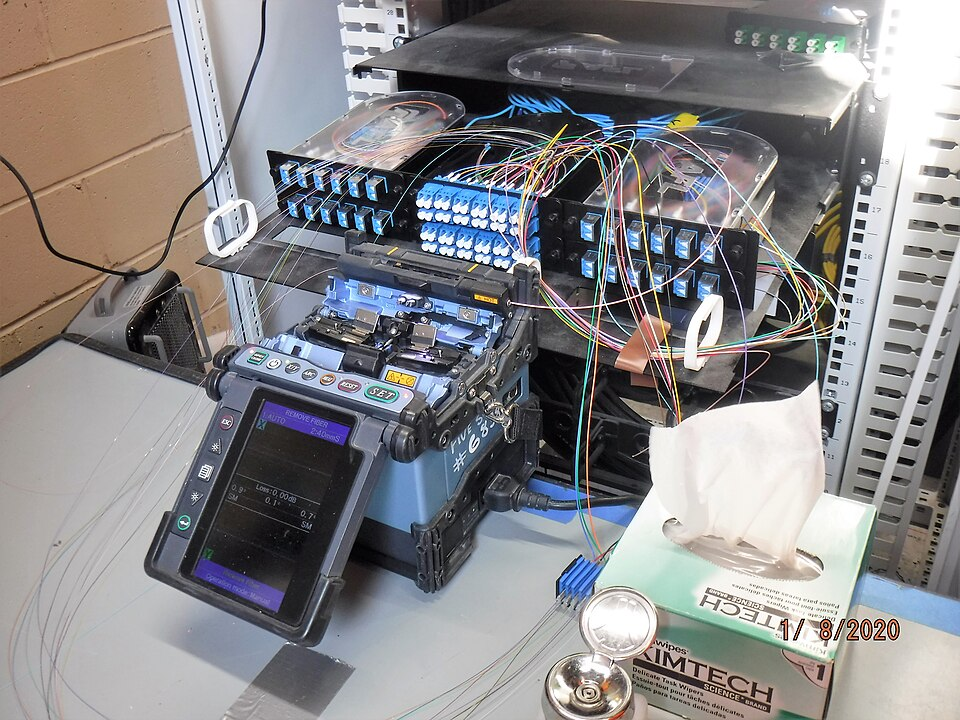

Figure: Field fusion splicing of multiple fiber strands in a distribution frame. Traditional splicing is laborious and requires specialized equipment.

Managing this complexity on-site drives up labor hours and error rates. For example, legacy splitters and high-count FDH cabinets often ship with long pre-installed tails that must be field-spliced into feeder and drop fibers, requiring vault access and careful alignment. Each splice and adapter insertion takes time and skill; one industry article notes that eliminating a second splice step can cut a cabinet installation from 6–9 hours down to 2–5 hours[10]. In short, compatibility issues and non-standard assemblies directly slow installation speed and inflate build costs.

Broad deployment also runs into supply chain bottlenecks. During COVID and its aftermath, fiber component shortages, shipping delays, and rising freight costs plagued the industry. For example, an FBA supply-chain survey reports a severe shortage of truck drivers (a U.S. shortfall of ~50,000 drivers today, projected to 174,000 by 2026[11]. Because roughly 72% of U.S. freight moves by truck, driver scarcity has delayed shipments of cables, hardware and even activated services. At one point, sky-high container rates reversed (air freight briefly cheaper than sea), but ongoing instability still means unexpected delays.

Other infrastructure crunches add to the strain. Worldwide semiconductor shortages have hampered production of broadband electronics and even construction equipment. For instance, aerial bucket trucks (used to string fiber on poles) have been impacted by the chip crunch[12]. Fewer new trucks on the market has driven up prices of used units and rental rates. All of this means crews sometimes sit idle, waiting for material or equipment that was ordered months earlier. Overall, large-scale rollouts must plan for longer lead times and buffer stock – adding inventory cost – just to keep field teams moving.

To surmount these last-mile hurdles, the industry is turning to “craft-friendly” and pre-integrated solutions that minimize on-site work. These innovations are proven to speed installation, boost performance, and trim costs. For example, pre-connectorized, factory-tested drop cables and modular enclosures allow much of the work to be done in controlled factory conditions. Evaluations have shown that pre-terminated fiber solutions can be installed five times faster than traditional fusion-spliced drop cables[13]. Similarly, applying modern enclosure designs and hardened interfaces dramatically cuts field labor. Key solution categories include:

These solution elements together re-shape deployment economics. Factory-tested, plug-and-play parts slash labor hours; sealed, modular hardware cuts error rates and rework. Time-to-revenue shortens as more of the work shifts off-site or into simple plug-in steps. For example, replacing double-splicing with cassette splicing saved a provider 50% of its installation time in a trial, equating to thousands of dollars per site[20]. In this way, next-generation components directly improve installation speed, service quality, and cost efficiency in the last mile.

Figure: A weatherproof 6-port fiber distribution junction box (outdoors). Flexible enclosure designs like this can serve as either indoor or outdoor terminals, simplifying last-mile drop terminations.

Underlying these product innovations is the growing importance of vertically integrated suppliers. A manufacturer with in-house design and full line control can optimize each component for compatibility and performance. By engineering products end-to-end, such suppliers eliminate interface mismatches and deliver consistent quality. This vertical integration also accelerates customer-driven innovation: field feedback on issues (for example, connector fit or environmental sealing) can be rapidly folded into new product revisions, since R&D and production are co-located.

The benefits are tangible. For instance, when a global infrastructure provider adopted a modular fiber platform, it reduced its part count by 75% and cut new product development time in half[21]. Industry analysts note that moving toward integrated “system solutions” is enabling new levels of deployment efficiency[22]. In practice, working with a full-stack fiber connectivity partner means simpler procurement, fewer supply-chain touchpoints, and one-stop technical support. It also means evolving markets (data centers, enterprise networks, telecom cores, edge and 5G fronthaul) are better served with tailored solutions that cross over applications.

In summary, addressing last-mile barriers requires both process changes and better components. Streamlining permitting and training is essential, but so is using smarter hardware. Pre-tested cables, modular closures, hardened terminals, and versatile distribution boxes are already proving essential to reducing rollout time and improving reliability. Suppliers that combine these innovations with vertical integration are helping operators meet the exploding demand for datacom, FTTx, and 5G connectivity with higher speed and lower total cost.

Sources:

If you want to know more about us, you can fill out the form to contact us and we will answer your questions at any time.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

These cookies are used for managing login functionality on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Clarity is a web analytics service that tracks and reports website traffic.

Service URL: clarity.microsoft.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy for ADTEK.